Before going home to have nice dinner today. Let's know more about withholding configuration ^___^. Here is an easy step to assign withholding tax type to company code. Let's check it out !!

Withholding Tax Type can be assigned in level of company code. In this activity, you have to set characteristic of each withholding tax type of each company.

You will see that there are 2 sections on this screen which are vendor and customer. Let’s see explanation of each parameter by starting from vendor data.

Withholding tax agent: Select this function to let’s system know that this company code is entitled to withhold tax on behalf of vendor.

Validity Period: Enter valid period of withholding tax type. You will see that this function is valid only in section of vendor. For customer, you have to enter valid period of each withholding tax type in customer master in company code level.

Withholding tax number: Enter tax number of your company. Tax number is issues by tax authorities.

Subject to withholding tax: Select this function to let system know that this company code subject to withholding tax

Self-withholding tax agent: The company code can withhold tax on its own behalf for this withholding tax type.

Exemption Number: Numbered assigned by the relevant authorities for exemption from withholding tax. This configuration is applied in case of customer only. For vendor, you have to assign exemption number in vendor master data in company code level.

Exemption Reason: Indicator used to classify different types of exemption from liability to a particular withholding tax.

Exemption Rate: This exemption rate is use to reduce from normal withholding tax rate. If withholding tax rate is 10% from 100 USD and you enter exemption rate at 3%, system will reduce withholding tax from 10 USD to 7 USD.

Exempt From: Enter the first date which exemption applies

Exempt to: Enter the last date which exemption applies

Withholding Tax Type can be assigned in level of company code. In this activity, you have to set characteristic of each withholding tax type of each company.

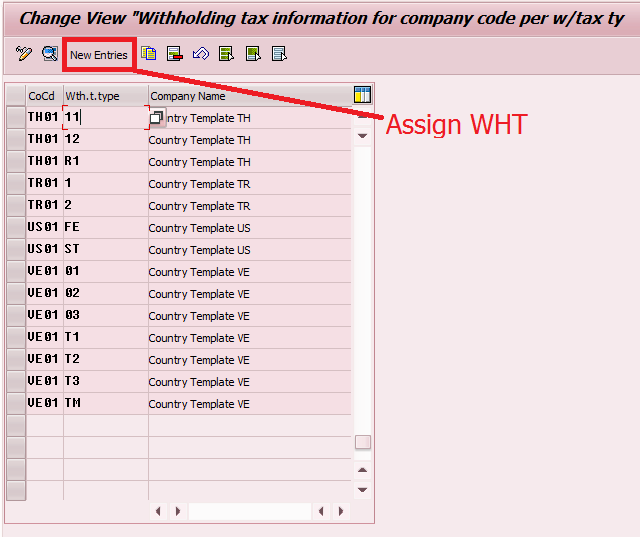

How to assign withholding tax type to company code

Menu Path: SPRO -> Financial Accounting (New) -> Financial Accounting Global Settings (New) -> Withholding Tax -> Extended Withholding Tax -> Company Code -> Assign Withholding Tax Types to Company Codes

T-Code: N/A

1. Press <New Entries Button> to assign new withholding tax to company code.

2. Enter WHT characteristic

You will see that there are 2 sections on this screen which are vendor and customer. Let’s see explanation of each parameter by starting from vendor data.

Vendor Section

Withholding tax agent: Select this function to let’s system know that this company code is entitled to withhold tax on behalf of vendor.

Validity Period: Enter valid period of withholding tax type. You will see that this function is valid only in section of vendor. For customer, you have to enter valid period of each withholding tax type in customer master in company code level.

Withholding tax number: Enter tax number of your company. Tax number is issues by tax authorities.

Customer Section

Subject to withholding tax: Select this function to let system know that this company code subject to withholding tax

Self-withholding tax agent: The company code can withhold tax on its own behalf for this withholding tax type.

Exemption Number: Numbered assigned by the relevant authorities for exemption from withholding tax. This configuration is applied in case of customer only. For vendor, you have to assign exemption number in vendor master data in company code level.

Exemption Reason: Indicator used to classify different types of exemption from liability to a particular withholding tax.

Exemption Rate: This exemption rate is use to reduce from normal withholding tax rate. If withholding tax rate is 10% from 100 USD and you enter exemption rate at 3%, system will reduce withholding tax from 10 USD to 7 USD.

Exempt From: Enter the first date which exemption applies

Exempt to: Enter the last date which exemption applies

Label: Withholding Tax Configuration in sap, How to assign withholding tax to company code in sap, how to assign withholding tax type to company code in sap, how to assign wht type to company code in sap, how to assign wht in sap, how to assign withholding tax in sap.